irs tax attorney austin

88-2279325 Austin TX United States. You will conduct interviews and review records to gain an understanding of each taxpayers.

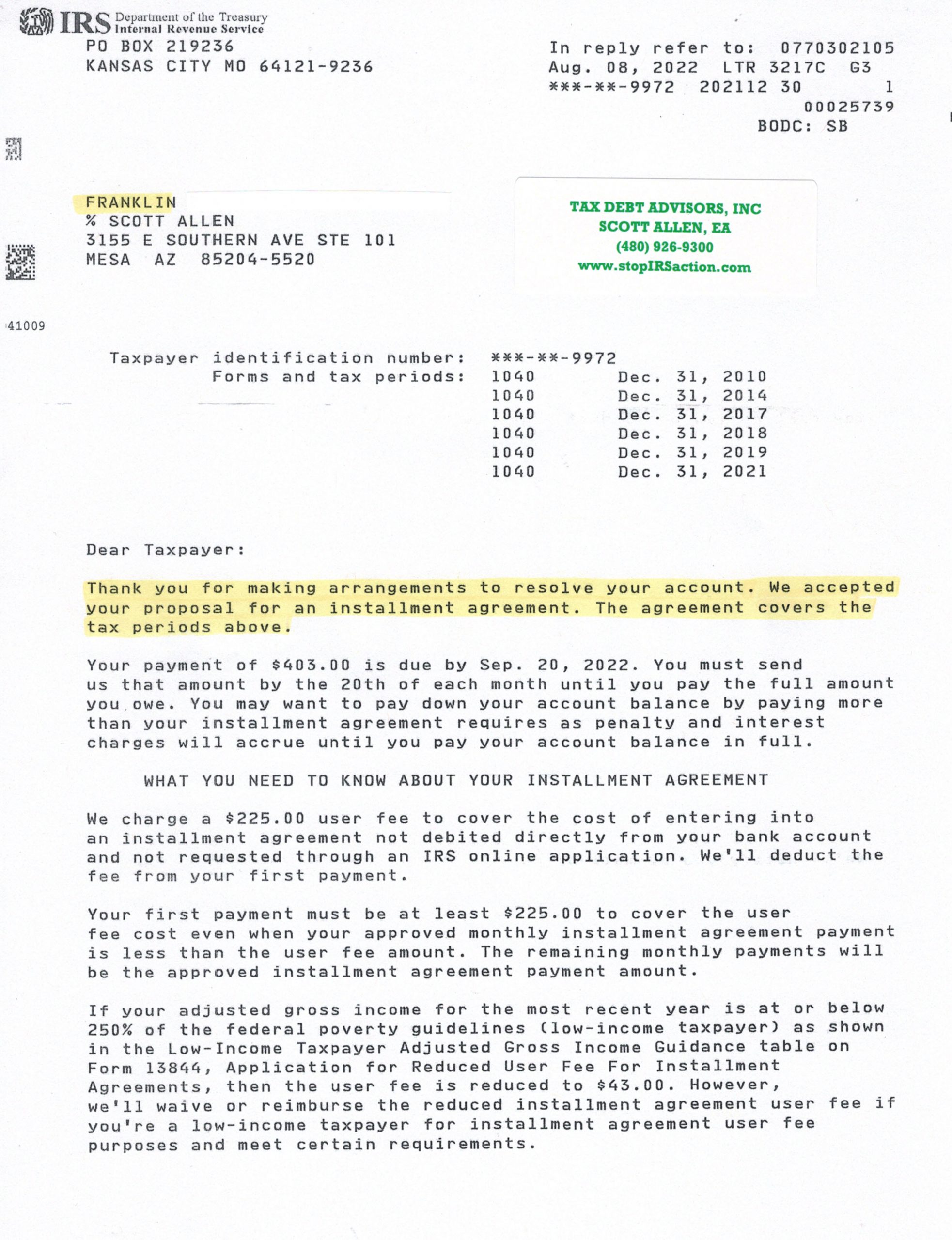

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

5 - February 28 2018 at participating offices to qualify.

. Internal Revenue Service 3651 S IH35 MS 4301AUSC Austin TX 78741. 3651 S IH35 Austin TX 78741. Apply for an ITIN.

Trudy Austin ordained in 2018 had 400 or more in net self-employment earnings in both 2018 and 2021 part. They analyze taxpayers financial condition and related operations. The committee is a public forum for the discussion of electronic tax administration issues and its core goal is to promote paperless filing of tax and information returns.

We have opportunities for individuals interested in applying their analytical and investigative skills to educate customers on meeting their tax responsibilities while enforcing the tax laws. The Pathways Program provides internship and long-term career development opportunities to student and. The IRS is hosting hiring events for the following positions.

Go to the IRS Interactive Tax Assistant page at IRSgovHelpITA where you can find topics by using the search feature or viewing the categories listed. Schedule payments up to a year in advance. No fees from IRS.

IRS Tax Compliance Officers plan and conduct examinations and investigations of individual and business taxpayers. Form 1040EZ is generally used by singlemarried taxpayers with taxable. If you do join us you wont be disappointed with the many benefits we offer the opportunities for advancement or the dedicated.

The IRS is hosting hiring events for the following positions. Be permitted when signing other documents such as S-elections applications for change in accounting method powers-of-attorney consent forms revenue agent reports and other case inquiryresolution related documents requiring signature. Pay Now with Direct Pay.

If you know or suspect that you are the target of an IRS criminal tax investigation contact the dual licensed Criminal Tax Defense Attorneys CPAs at the Tax Law Offices of David W. They also provide advice regarding tax law and tax-related accounting and serve the nation by becoming the single point of contact to resolve both general and. Apply for Power of Attorney Form W-7.

Get step-by-step guidance that will answer all of your questions on having your IRS tax debt expire by Clicking HereLandmark Tax Group is operated by Michael Raanan MBA EA an IRS-licensed Tax Relief Specialist Enrolled Agent and a former Senior IRS Agent. Rules Governing Practice before IRS. IRSs latest appointees take up their posts as the agency works to clear a backlog of at least 87 million unprocessed individual tax returns filed so far this year and as.

For details on how to pay see your tax return instructions visit IRSgov or call 800-829-1040. Power of Attorney required. There are a number of options to satisfy the tax lien.

We can provide you with a reduced rate assessment for your first call to our offices at 800 681-1295. Instructions for Form 1040 Form W-9. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom.

File Form 1040 or 1040-SR by April 18 2022. Austin - Internal Revenue Submission Processing Center. Normally if you have equity in your property the tax lien is paid in part or in whole depending on the equity out of the sales proceeds at the time of closing.

Apply for Power of Attorney Form W-7. Apply for Power of Attorney Form W-7. Identity Thieves Earn Cyber Cash Stick Victims With Tax Bill Imagine getting a bunch of tax documents telling you and the IRS about a large sum of money you made when in fact you never received.

You can get help by phone or you can visit the office for in-person assistance. Publication 3 - Introductory Material Whats New Reminders Introduction. Due date of return.

Apply for Power of Attorney Form W-7. At the entry level you would. For all taxpayers who are bona fide residents of the Commonwealth of the Northern Mariana Islands Guam Puerto Rico or the US.

Apply for Power of Attorney. If you elected to defer the payment of any tax due per the instructions under Part II Section D Line 5 for Form 8854 send your tax deferral agreement request to the new address listed below. The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbiaeven if you dont live in.

To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number. Getting tax forms instructions and publications. A copy of the Form 8854 must also be filed with Internal Revenue Service at 3651 S IH 35 MS 4301 AUSC Austin TX 78741 by the due date of the tax return including extensions.

Go to the IRS Interactive Tax Assistant page at IRSgovHelpITA where you can find topics using the search feature or by viewing the categories listed. Estimated tax payments must be made as the tax liability is incurred by April 15 2021. This position reviews tax returns for accuracy and completeness reviews and codes tax returns for computer processing resolves errors and corresponds with taxpayers to obtain any missing information.

Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. Apply for an ITIN Circular 230. Find answers to frequently asked questions about Foreign Account Tax Compliance FATCA.

From researching complex tax law to providing basic instruction on filing requirements and extensions to help them fulfill their Federal Tax obligations. A faxed signature is acceptable on Form. While working over 18 years at the IRS and in private practice helping taxpayers like you Michael has personally resolved.

Apply for an ITIN. Click here to learn more Pathways Program The IRS benefits from a diverse workforce that includes students and recent graduates who infuse the workplace with their enthusiasm talents and unique perspectives. Business and Tax Enforcement is a vital part of the IRS.

Virgin Islands see Pub. If you file your Form 1040 or 1040-SR by January 31 2022 and pay the rest of the tax that you owe with the form you dont need to make the payment due on January 18 2022. Click here to learn more.

Apply for an ITIN. And January 18 2022. Apply for an ITIN.

Type of federal return filed is based on your personal tax situation and IRS rules. Consult your attorney for legal advice. Pub 78 Data.

If you visit the Austin IRS office please tell us about your experienceIt can be useful for others seeking help for a tax problem. Read breaking headlines covering Congress Democrats Republicans election news and more. Can delegate authorization to complete Part 4 by signing a Form 2848 Power of Attorney Form and Declaration of Representative or other similar form or.

If there is a federal tax lien on your home you must satisfy the lien before you can sell or refinance your home. Individual Tax Return Form 1040 Instructions. If you want to apply your accounting skills to a role that puts you directly in touch with numbers you should be one of our Tax Examiners.

See Expatriation Tax the Form 8854 instructions and Notice 2009-85 Guidance for Expatriates Under Section 877A for further details. HR Block Audit Representation constitutes tax advice only. Austin Taxpayer Assistance Center is available to resolve your tax matters and clarify all your doubts.

Austin Fresno and Kansas City sites were assigned IMF work.

11 Best Austin Tax Attorneys Expertise Com

3 Best Tax Attorney In Austin Tx Expert Recommendations

Tax Attorney Houston The Woodlands San Antonio Austin

Irs Tax Attorney Tax Debt Advisors

Tax Attorney In Austin Tx Individual Business Tax Defense Lawyers

Austin C Bradley Attorney Mcgrath North Mullin Kratz Pc Llo

Mondrik Associates State And Federal Tax Controversies Litigation Christi Mondrik

Best Austin Tx Tax Attorneys Super Lawyers

Taxes International Students And Scholars Office The University Of Texas At Dallas

Austin Tax Relief Attorney 800 521 0230

Tax Attorney In Austin Tx Individual Business Tax Defense Lawyers

Irs Letter 39 Lt39 Reminder Of Overdue Taxes H R Block

Chicago Tax Attorney Kevin Benjamin

Irs Tax Attorney Services Louisiana Bryson Law Firm

San Antonio Tax Attorney Irs Tax Settlement San Antonio Tax Attorney San Antonio Tax Lawyer Tax Attorney San Antonio Tax Lawyer San Antonio Tax Attorney In San Antonio Tax Lawyer In San

Irs Tax Attorney Cpa Irs Tax Audit Levy Garnishment

Babbitt Tax Law Naples Irs Tax Attorney Fort Myers Irs Tax Lawyer

Texas Tax Attorney Tax Litigation Irs Lawyer Lawyer Referral Service